Understanding the Basics of ACA Health Insurance Enrollment

Understanding the basics of ACA health insurance enrollment is essential for ensuring you have access to necessary healthcare services. The Affordable Care Act (ACA) provides a structured process for individuals and families to obtain coverage through the Health Insurance Marketplace. Enrollment typically occurs during an annual open enrollment period, but qualifying life events such as marriage or the birth of a child can allow for special enrollment opportunities.

It’s important to compare different plans based on premiums, deductibles, and coverage options to find the best fit for your needs. Additionally, financial assistance may be available for those with low to moderate incomes, making healthcare more accessible. Being informed about these aspects can help you make better choices regarding your health insurance.

Also Read: undefined

Key Dates to Remember for ACA Enrollment Periods

The Affordable Care Act (ACA) enrollment periods are crucial for securing health insurance coverage. Key dates to remember include the annual Open Enrollment Period, which typically begins on November 1 and ends on December 15, providing a window for individuals to sign up or make changes to their plans.

For those eligible for Special Enrollment Periods due to life events like marriage or relocation, it’s essential to act swiftly, as these windows usually last 60 days. Additionally, keep an eye on deadlines for premium payments to maintain coverage. Understanding these key dates ensures that individuals can take full advantage of the healthcare options available, fostering access to essential medical services and safeguarding their health and financial stability.

Step-by-Step Guide to Enrolling in ACA Coverage

You might like: undefined

Enrolling in ACA coverage is a straightforward process that can be accomplished in a few simple steps. First, visit the HealthCare.gov website to create an account. Once registered, you can browse available plans in your state. It’s essential to compare coverage options, premiums, and out-of-pocket costs to find the best fit for your needs.

Next, gather necessary documents, such as proof of income and residency, which will help in determining your eligibility for financial assistance. After selecting a plan, complete the application by providing the required information and submitting it. Be mindful of enrollment deadlines, as missing them could mean waiting until the next open enrollment period.

Finally, review your coverage details and keep track of any correspondence from your insurer to ensure a smooth experience throughout the year.

Eligibility Requirements for ACA Health Insurance

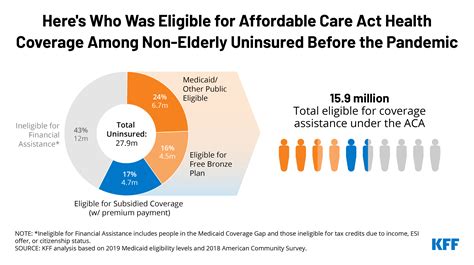

To be eligible for ACA health insurance, individuals must meet certain criteria that ensure they can access affordable coverage. Firstly, applicants must be U.S. citizens or legal residents, as non-residents do not qualify for ACA plans. Additionally, individuals should not be incarcerated or currently serving time in prison, as this can affect eligibility.

The income level is another critical factor, where applicants must fall within a specific range, typically between 100% and 400% of the federal poverty level, to receive subsidies that lower monthly premiums and out-of-pocket costs. Furthermore, it is important for applicants to not have access to other affordable health coverage options, such as Medicaid or employer-sponsored insurance, as having such coverage can disqualify them from ACA plans.

Lastly, enrollment periods must be observed, as individuals can only apply for ACA insurance during designated open enrollment times, unless they qualify for a special enrollment period due to life events like marriage, childbirth, or loss of previous coverage. Understanding these requirements helps individuals navigate the health insurance landscape effectively and ensures they find the appropriate coverage for their needs.

You will definitely like this article: undefined

Common Mistakes to Avoid During ACA Enrollment

During ACA enrollment, many individuals make common mistakes that can lead to complications. One frequent error is failing to review eligibility requirements thoroughly, which may result in selecting a plan that doesn’t meet their needs. Additionally, some applicants overlook the importance of understanding the different types of coverage available, leading to inadequate health protection.

Another mistake is not providing accurate income information, which can affect premium tax credits. It’s also crucial to pay attention to enrollment deadlines; missing these can mean waiting another year for coverage. Lastly, many people neglect to compare plans effectively, missing out on better options that could save them money.

By avoiding these pitfalls, individuals can ensure a smoother enrollment experience and better health coverage.

Comparing Different ACA Health Insurance Plans

When comparing different ACA health insurance plans, it’s crucial to consider various factors that can significantly impact your healthcare experience. Each plan typically offers a unique blend of premiums, deductibles, and out-of-pocket maximums, which can influence your overall costs. Additionally, the network of healthcare providers plays a vital role; some plans may restrict access to specific doctors or hospitals, while others offer broader choices.

It’s also important to evaluate the covered services, as not all plans include the same treatments or medications. Understanding these differences can empower you to choose a plan that not only meets your financial needs but also aligns with your healthcare preferences, ensuring you receive the best possible care.

How to Use the Health Insurance Marketplace Effectively

Navigating the Health Insurance Marketplace effectively requires a clear understanding of your options and needs. Start by assessing your healthcare requirements, including regular prescriptions and doctor visits, to determine the type of coverage that suits you best. During the open enrollment period, compare plans based on premiums, deductibles, and out-of-pocket costs, while also considering the network of providers available.

Utilize the online tools and resources provided by the marketplace to estimate your potential savings and explore eligibility for subsidies. Lastly, don’t hesitate to ask questions or seek assistance from certified navigators or agents, as they can guide you through the process and help ensure you make informed decisions that align with your health and financial goals.

The Importance of Open Enrollment for ACA Health Insurance

Open enrollment for the Affordable Care Act (ACA) health insurance is a critical period that allows individuals and families to secure necessary coverage. This timeframe offers an essential opportunity for those who may have experienced life changes, such as job loss or changes in income, to enroll in plans that suit their healthcare needs.

During open enrollment, consumers can compare various plans, ensuring they select one that aligns with their budget and coverage requirements. The significance of this period cannot be overstated, as it empowers people to make informed decisions about their health and finances. Additionally, it helps to promote health equity, as more individuals gain access to preventive services and essential care, ultimately contributing to improved public health outcomes.

Financial Assistance Options Available for ACA Enrollment

Financial assistance options for ACA enrollment are vital for many individuals seeking affordable healthcare. Various programs, including premium tax credits and cost-sharing reductions, help lower costs based on income levels. These subsidies make insurance more accessible, allowing families to choose plans that meet their needs without financial strain.

Additionally, Medicaid expansion in certain states provides coverage for those with lower incomes. It’s essential for applicants to explore all available resources, including local navigators and online tools, to maximize their benefits during the enrollment period. Understanding these options can significantly impact overall healthcare access and affordability, ensuring that more people can receive necessary medical services.

Frequently Asked Questions About ACA Health Insurance

The Affordable Care Act (ACA) has transformed the health insurance landscape, leading to many frequently asked questions among consumers. One common query is about eligibility; individuals must meet specific criteria to enroll, including income limits and residency requirements. Another question often arises regarding coverage options, as ACA plans provide essential health benefits, such as preventive services, hospitalization, and prescription drugs.

Many people also wonder about the enrollment process, which typically occurs during open enrollment periods, although special enrollment may be available due to life events. Additionally, understanding costs, such as premiums, deductibles, and out-of-pocket expenses, is crucial for prospective enrollees.

Overall, the ACA aims to make healthcare more accessible, but navigating its complexities can leave many with uncertainties that need clarification.

How to Update Your ACA Enrollment Information

Updating your ACA enrollment information is essential to ensure you have the right coverage. First, log in to your HealthCare.gov account or your state’s health insurance marketplace. Navigate to the “My Applications & Coverage” section, where you can find your enrollment details. If you’ve had changes in your household, income, or residency, it’s crucial to report these changes as they can affect your eligibility and premium costs.

To make updates, follow the prompts provided. Be sure to have your new information ready, such as income documents or changes in family size. After submitting your updates, review your new plan options carefully, as they may differ from your previous coverage. Finally, confirm your changes to ensure your health insurance is accurate and up to date for the coming year.

Tips for Choosing the Right ACA Plan for Your Needs

Choosing the right ACA plan can feel overwhelming, but with a strategic approach, you can find the perfect fit for your needs. Start by evaluating your healthcare requirements, considering factors like frequency of doctor visits and prescription medications. Compare plan premiums and deductibles to ensure they align with your budget.

Don’t overlook the plan’s network; in-network providers can significantly reduce out-of-pocket costs. Additionally, review the coverage specifics, such as preventive services and specialist visits, to ensure they meet your expectations. Finally, consider seeking advice from a healthcare navigator or using online resources to clarify any uncertainties.

Making an informed decision will empower you to secure the best health coverage for you and your family.

Understanding the Premium Tax Credit for ACA Plans

The Premium Tax Credit (PTC) is a crucial component of the Affordable Care Act (ACA), designed to make health insurance more affordable for low-to-moderate-income individuals and families. This credit helps reduce the monthly premiums for insurance plans purchased through the Health Insurance Marketplace.

To qualify, applicants must meet certain income requirements, typically between 100% and 400% of the federal poverty level, and cannot be eligible for other forms of coverage, such as Medicaid. The amount of the credit is based on the household size and income, ensuring that those who earn less receive greater assistance.

Understanding the PTC is essential for maximizing savings and ensuring access to necessary healthcare services, making it a vital aspect of securing affordable health insurance under the ACA.

Navigating Special Enrollment Periods for ACA Coverage

Navigating Special Enrollment Periods for ACA coverage can be a crucial step for many individuals seeking health insurance. These periods allow people to enroll outside the typical open enrollment window, often triggered by life events such as marriage, the birth of a child, or job loss. Understanding the specific qualifications and deadlines associated with these special enrollment periods is essential to ensure you don’t miss out on necessary coverage.

It’s important to gather required documentation and act quickly, as these windows can be limited. By staying informed about your options and the enrollment process, you can secure the health insurance you need, providing peace of mind for you and your family during uncertain times.

What to Do If You Miss the ACA Enrollment Deadline

If you miss the ACA enrollment deadline, there are still options available to secure health insurance. First, you might qualify for a Special Enrollment Period (SEP) due to specific life events such as marriage, having a baby, or losing other health coverage. It’s essential to apply within 60 days of the qualifying event.

If you don’t qualify for an SEP, you can consider alternative coverage options like short-term health insurance or Medicaid, depending on your income and state eligibility. Additionally, some states have their own health insurance marketplaces with extended enrollment periods. Keep in mind that you can always prepare for the next open enrollment period by researching plans and understanding your healthcare needs.

Being proactive will ensure you’re ready when the time comes.

The Role of Brokers in ACA Health Insurance Enrollment

Brokers play a crucial role in the enrollment process for health insurance under the Affordable Care Act (ACA). They serve as knowledgeable intermediaries, helping individuals and families navigate the complex landscape of health insurance options. Brokers assist clients in understanding the various plans available, including coverage details, premiums, and out-of-pocket costs.

Their expertise enables them to tailor recommendations based on individual needs and financial situations. Furthermore, brokers are instrumental in guiding clients through the enrollment process, ensuring that they meet deadlines and complete necessary paperwork. By fostering informed decision-making, brokers not only enhance the enrollment experience but also contribute to improved health outcomes by helping people secure appropriate coverage.

Ultimately, their support is invaluable in making the ACA’s health insurance marketplace accessible to a wider audience.

Understanding the Penalties for Not Having ACA Coverage

Understanding the penalties for not having Affordable Care Act (ACA) coverage is crucial for individuals navigating the complex landscape of health insurance. The ACA mKamutes that most Americans maintain a minimum level of health insurance to avoid tax penalties. If you do not have coverage for a certain period, you may face a penalty when filing your federal tax return, which can be a percentage of your income or a flat fee, whichever is higher.

This penalty is designed to encourage enrollment in health plans and promote overall public health. Additionally, lacking ACA coverage can lead to significant out-of-pocket expenses for medical services, making it vital to evaluate your insurance options carefully. Understanding these implications helps individuals make informed decisions about their health care and financial well-being.

Resources for Assistance with ACA Enrollment Process

Resources for assistance with the ACA enrollment process are widely available to help individuals navigate their healthcare options. The HealthCare.gov website provides essential information on plan comparisons, eligibility requirements, and enrollment deadlines. Additionally, local enrollment assistance can be found through community organizations, navigators, and certified agents who offer personalized support.

Many states also have their own health insurance marketplaces, which can provide tailored resources and assistance. Utilizing these resources can help ensure a smoother enrollment experience and better understanding of available healthcare choices.

How ACA Enrollment Affects Your Taxes and Finances

Enrolling in an Affordable Care Act (ACA) health plan can significantly impact your taxes and finances. When you apply for coverage, you may qualify for premium tax credits based on your income, which can lower your monthly premium costs. However, it’s essential to report your estimated annual income accurately, as underreporting can lead to repayment of excess credits when filing your taxes.

Additionally, the ACA mKamutes that you have health insurance or face a penalty, although this penalty has been reduced in many states. Having ACA coverage can also affect your eligibility for other financial assistance programs. Overall, understanding these implications is crucial for effective financial planning and ensuring compliance with tax regulations.

The Future of ACA Health Insurance Enrollment Policies

As the landscape of health insurance continues to evolve, the future of ACA health insurance enrollment policies holds significant promise. Innovations in technology, such as streamlined online platforms and AI-driven customer service, are set to enhance user experience, making enrollment more accessible and efficient.

Moreover, policymakers are increasingly focusing on inclusivity, aiming to cater to diverse populations with tailored options that meet specific needs. The potential for automatic re-enrollment and simplified eligibility checks could reduce gaps in coverage, ensuring that more individuals benefit from essential health services.

Additionally, educational initiatives are likely to play a crucial role in raising awareness about available options, empowering consumers to make informed decisions. Overall, these advancements signal a progressive shift toward a more responsive and user-friendly health insurance system under the ACA framework.

Final Thoughts

As we conclude our discussion on ACA health insurance enrollment, it’s essential to remember that accessing affordable healthcare is a vital step towards ensuring the well-being of you and your loved ones. Whether you’re enrolling for the first time or reviewing your options, being informed is key to making the best choices for your health needs.

Thank you for reading, and don’t forget to share this article with your friends. Goodbye, and we look forward to bringing you another interesting article soon!

-

ACA health insurance enrollment

-

aca health insurance enrollment period

-

aca health insurance open enrollment

-

aca asuransi kesehatan

-

aca health insurance indonesia

-

health insurance aca

-

aca hotline

-

aca hris

-

health insurance aca requirements

-

aca asuransi jambi

-

aca jakarta

-

aca life insurance

evolky