Understanding Monthly Health Insurance Costs in 2025

Understanding monthly health insurance costs in 2025 involves examining several key factors that influence premiums. As healthcare continues to evolve, the costs are affected by inflation, changes in healthcare regulations, and the overall demand for medical services. Additionally, insurance providers are increasingly using advanced data analytics to tailor premiums based on individual health profiles and risk factors.

In 2025, consumers may notice a broader range of plan options, with some focusing on preventive care to reduce long-term expenses. It’s crucial to compare different plans and consider out-of-pocket costs, deductibles, and coverage limits. By staying informed and understanding these elements, individuals can make better decisions regarding their health insurance, ensuring they find a plan that meets their needs and budget effectively.

Also Read: Private vs Public Health Insurance: Which Is Better?

Factors Influencing Health Insurance Premiums in 2025

In 2025, several factors are influencing health insurance premiums, making it essential for consumers to understand these dynamics. First, the aging population significantly impacts costs, as older individuals typically require more medical care. Additionally, advancements in medical technology and treatments can lead to higher expenses, which insurers often pass on to policyholders.

Geographic location also plays a crucial role; areas with higher healthcare costs tend to see increased premiums. Furthermore, changes in government regulations and policies surrounding healthcare can affect premium rates, either by mandating coverage or adjusting subsidy levels. Lastly, lifestyle choices, such as smoking and obesity, contribute to individual risk assessments, influencing personal premium rates.

Together, these factors create a complex landscape for health insurance pricing in 2025, requiring consumers to stay informed and proactive.

Comparative Analysis of Health Insurance Prices in 2025

You might like: How to Choose the Right Health Insurance Plan for Your Family

In 2025, a comparative analysis of health insurance prices reveals significant disparities across various providers. Factors influencing these costs include coverage options, deductible amounts, and network accessibility. While some insurers offer competitive rates, others may impose higher premiums for extensive benefits.

Regional variations also play a crucial role, as urban areas often experience elevated prices compared to rural regions. Moreover, the growing emphasis on telehealth services has prompted some companies to adapt their pricing structures. Consumers are encouraged to evaluate their specific health needs and financial situations when selecting a plan, as this can lead to substantial savings.

Ultimately, staying informed about the evolving landscape of health insurance is vital for making cost-effective choices in healthcare.

Average Monthly Health Insurance Costs Across States in 2025

In 2025, average monthly health insurance costs across the United States vary significantly from state to state, influenced by factors such as local healthcare costs, population health, and state regulations. States like California and New York tend to have higher premiums, averaging around $600 per month, due to their larger urban populations and increased demand for services.

In contrast, states such as Alabama and South Dakota may see average costs as low as $350, benefiting from lower overall healthcare expenses and a smaller number of high-cost claims. The differences highlight the importance of understanding regional health markets and the impact of state policies on insurance pricing.

As healthcare continues to evolve, monitoring these costs will be crucial for individuals seeking affordable coverage while ensuring access to quality medical services.

You will definitely like this article: undefined

Health Insurance Cost Trends: What to Expect in 2025

As we look ahead to 2025, understanding health insurance cost trends is crucial for consumers and businesses alike. Premiums are expected to continue rising due to several factors, including increased healthcare utilization, advancements in medical technology, and an aging population. Additionally, the impact of inflation on overall healthcare costs will likely contribute to higher premiums.

Insurers may also adjust their pricing models to account for more comprehensive benefits and preventive care services. Consumers can expect to see variations in costs based on geographic location and the type of plan they choose. Staying informed about these trends will be essential for making educated decisions regarding health insurance coverage in the coming years.

How Age Affects Health Insurance Premiums in 2025

As we move into 2025, the relationship between age and health insurance premiums continues to evolve. Generally, younger individuals tend to pay lower premiums due to their typically healthier lifestyles and reduced likelihood of requiring extensive medical care. However, as people age, their health risks increase, leading to higher premiums.

Insurers assess age as a critical factor, reflecting the anticipated costs associated with age-related health issues. Additionally, older adults may face challenges in finding affordable coverage, as insurers often adjust rates based on demographic factors. It’s essential for consumers to understand these dynamics and explore various options to mitigate costs.

In response to these trends, some companies are developing tailored plans to cater to older populations, aiming to balance coverage needs with affordability. This shift highlights the ongoing importance of age in shaping health insurance landscapes.

The Impact of Health Conditions on Insurance Costs in 2025

In 2025, the interplay between health conditions and insurance costs has become increasingly pronounced, as insurers adapt to a landscape marked by rising healthcare expenses and a greater emphasis on preventive care. Individuals with chronic illnesses or pre-existing conditions often find themselves facing higher premiums, reflecting the anticipated higher costs associated with their ongoing medical needs.

Conversely, those who prioritize their health through regular check-ups and healthy lifestyles may benefit from lower rates and incentives, showcasing a shift towards personalized insurance models. This evolving dynamic not only influences individual financial planning but also underscores the importance of proactive health management in mitigating long-term costs within the insurance industry.

Evaluating Plans: Choosing Affordable Health Insurance in 2025

As individuals seek affordable health insurance in 2025, evaluating plans becomes crucial. The rising cost of healthcare necessitates a careful assessment of available options. Start by comparing premiums, deductibles, and out-of-pocket expenses, as these factors significantly impact overall affordability.

It’s essential to consider the network of providers as well; a plan may have lower costs but limited access to preferred doctors. Additionally, review covered services and prescription drug benefits to ensure they meet your healthcare needs. Understanding the plan’s coverage for preventive care and chronic conditions can also influence your decision.

Utilize online tools and resources to compare plans effectively, and consult with insurance agents for personalized advice. By taking the time to evaluate these aspects, individuals can make informed choices that align with their financial and health requirements.

Government Subsidies and Their Effect on Health Insurance Costs

Government subsidies play a crucial role in shaping health insurance costs, particularly for low- and middle-income individuals. By providing financial assistance, these subsidies help to reduce the burden of premium payments, making health insurance more accessible. This, in turn, encourages more people to enroll in insurance plans, increasing overall coverage rates.

However, the impact of subsidies can be complex; while they lower immediate costs for consumers, they can also lead to higher premiums in the long run if not managed carefully. Insurers may raise prices to offset the costs of providing coverage, potentially negating the benefits of subsidies. Additionally, fluctuations in government funding can create instability in the market, affecting both insurers and consumers.

Ultimately, while subsidies are essential for promoting health insurance accessibility, their long-term effects necessitate ongoing evaluation and adjustment.

Monthly Health Insurance Costs for Families in 2025

As we move into 2025, families are feeling the pressure of rising monthly health insurance costs. On average, families can expect to pay around $1,200 per month, a significant increase from previous years. This surge is attributed to various factors, including inflation, advancements in medical technology, and an increase in healthcare utilization.

Many families are now considering high-deductible plans in hopes of lowering their monthly premiums, yet this often leads to higher out-of-pocket expenses. Additionally, navigating the complex insurance landscape can be challenging, with many families unsure of how to choose the right plan that balances cost and coverage.

As financial constraints tighten, prioritizing health insurance remains essential to ensure access to necessary medical services and protect against unexpected health issues.

Health Insurance Options for Self-Employed Individuals in 2025

In 2025, self-employed individuals have several health insurance options to consider that cater to their unique needs. One popular choice is the Health Insurance Marketplace, which provides access to various plans that can be tailored to individual requirements. Self-employed workers can also explore High Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs), allowing them to save for medical expenses while enjoying tax benefits.

Additionally, some may opt for professional associations that offer group insurance rates, making coverage more affordable. It’s crucial for self-employed individuals to compare premiums, deductibles, and coverage options carefully. Ultimately, selecting the right health insurance plan can ensure both financial stability and access to necessary healthcare services, making it an essential consideration for freelancers and entrepreneurs alike.

Understanding Deductibles and Premiums in Health Insurance

In health insurance, understanding deductibles and premiums is crucial for making informed decisions. A premium is the amount you pay, typically monthly, for your health insurance coverage. It is essential to budget for this cost, as it ensures that you have access to necessary medical services. On the other hand, a deductible is the amount you must pay out-of-pocket before your insurance begins to cover costs.

For instance, if your deductible is $1,000, you must pay that amount in medical expenses before your insurer contributes. Balancing these two components is vital; lower premiums often come with higher deductibles, while higher premiums may lead to lower deductibles. Understanding this relationship helps individuals choose the right plan for their health care needs and financial situation.

The Role of Marketplace Insurance Rates in 2025

In 2025, marketplace insurance rates play a crucial role in shaping the accessibility and affordability of healthcare for millions of individuals and families. As the landscape of health insurance continues to evolve, these rates reflect a balance between the cost of care and the financial capabilities of consumers.

With ongoing changes in regulations and the introduction of new healthcare policies, marketplace insurance rates are expected to adapt, influencing the choices available to consumers. Additionally, increased competition among insurers may lead to more innovative plans and improved coverage options, ultimately enhancing the overall healthcare experience for those relying on the marketplace for their insurance needs.

Predicting Health Insurance Costs for Seniors in 2025

As we approach 2025, predicting health insurance costs for seniors becomes increasingly critical. The aging population is expected to rise, leading to greater demand for healthcare services and subsequently higher insurance premiums. Factors such as advancements in medical technology, the prevalence of chronic conditions, and the overall economic landscape will play pivotal roles in shaping these costs.

Insurers may implement innovative pricing models to accommodate the unique health needs of seniors, focusing on preventative care and wellness programs. Additionally, government policies and subsidies will significantly influence affordability. Ultimately, understanding these dynamics will be essential for seniors and their families in planning for future healthcare expenses and ensuring access to necessary services.

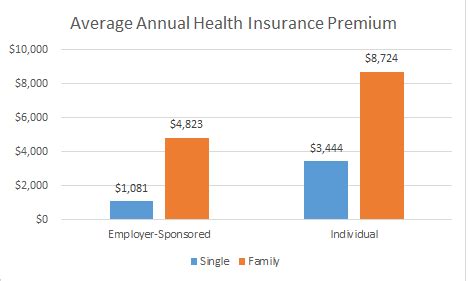

Exploring Employer-Sponsored Health Insurance Costs in 2025

As we delve into the landscape of employer-sponsored health insurance costs in 2025, several trends emerge that warrant attention. Rising healthcare expenses are leading employers to reassess their benefits packages, often resulting in increased premiums for employees. Many companies are exploring innovative strategies to mitigate these costs, such as adopting wellness programs and telehealth services that promote preventive care.

Additionally, a shift towards high-deductible health plans is becoming more prevalent, encouraging employees to take a more active role in their healthcare decisions. However, this trend may exacerbate disparities in access to care, particularly for lower-income workers. Understanding the implications of these changes is crucial for both employers and employees, as they navigate the complexities of health insurance in an evolving economic environment.

How Location Influences Health Insurance Pricing in 2025

In 2025, the influence of location on health insurance pricing has become increasingly pronounced, reflecting a complex interplay of factors unique to each region. Urban areas, often characterized by higher living costs, generally experience elevated premiums due to increased demand for healthcare services and advanced medical facilities.

Conversely, rural regions may benefit from lower prices, although they often face limited access to specialized care. Additionally, local health trends, such as prevalence of chronic illnesses or lifestyle-related conditions, significantly shape costs. Regulatory environments also vary, with some states imposing stricter pricing controls than others, further complicating the landscape.

As telehealth becomes more prevalent, the geographic gap in healthcare access may narrow, potentially leading to more uniform pricing in the future, yet the immediate impact of location remains a critical factor for consumers navigating their insurance options.

The Financial Impact of Health Insurance on Households in 2025

In 2025, the financial impact of health insurance on households has become increasingly significant as healthcare costs continue to rise. Families are faced with higher premiums, deductibles, and out-of-pocket expenses, which often strain their budgets. Many households are forced to make difficult choices between essential needs and health coverage, leading to increased financial stress.

Moreover, the affordability of health insurance has become a critical issue, with many opting for minimal coverage or going uninsured altogether. This trend can result in higher long-term costs due to delayed medical care and increased reliance on emergency services. As a result, the need for policy reforms that enhance the accessibility and affordability of health insurance has never been more urgent, aiming to protect families from financial hardship while ensuring they receive necessary medical care.

Navigating Health Insurance for Low-Income Families in 2025

Navigating health insurance in 2025 can be particularly challenging for low-income families, who often face a complex landscape of options and limitations. With rising medical costs and evolving policies, understanding available resources is crucial. Families must explore programs such as Medicaid and the Children’s Health Insurance Program (CHIP), which provide essential coverage for those who qualify.

Additionally, the Affordable Care Act continues to offer subsidies that can make marketplace plans more accessible. It’s vital for families to stay informed about open enrollment periods and to seek assistance from local health advocates or non-profits. By taking advantage of these resources, families can secure the health coverage they need, ensuring that financial constraints do not compromise their well-being.

Empowering families with knowledge is key to navigating this intricate system effectively.

The Future of Health Insurance: Cost Predictions for 2025

As we approach 2025, the landscape of health insurance is poised for significant transformation, driven by technological advancements and shifting consumer expectations. Predictive analytics and AI are set to revolutionize underwriting processes, potentially lowering premiums by optimizing risk assessments.

Telehealth services will likely become a stKamurd offering, enhancing accessibility while reducing costs associated with in-person visits. However, the rising costs of medical treatments and an aging population may counterbalance these savings, leading to a mixed outlook on affordability. Insurers will need to innovate continuously, exploring value-based care models that prioritize patient outcomes over service volume.

Ultimately, the future of health insurance will hinge on balancing technology-driven efficiencies with the pressing need for sustainable, equitable solutions that cater to diverse populations.

Tips for Finding Affordable Health Insurance in 2025

Finding affordable health insurance in 2025 can be challenging, but a few strategic tips can help. First, assess your healthcare needs and budget to determine the type of coverage you require. Compare plans using online marketplaces, which provide side-by-side comparisons of premiums, deductibles, and out-of-pocket costs.

Consider enrolling in a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) plan, as these often offer lower premiums. Additionally, check if you qualify for government subsidies or programs, as they can significantly reduce costs. Don’t overlook preventive care services, which many plans cover without additional charges.

Finally, read reviews and consult with insurance agents to gain insights into the quality and reliability of different providers. By staying informed and proactive, you can secure affordable health insurance tailored to your needs.

As we step into 2025, one common question arises: How much does health insurance cost per month in 2025? The answer varies significantly depending on the country and the type of coverage. In the United States, understanding how health insurance works is key, as premiums often depend on factors like age, location, and income. Meanwhile, health insurance in Indonesia remains more affordable compared to Western countries, but with rising health care costs and growing health expenditure, the average monthly premium is slowly increasing. Many wonder, how much is health insurance in Indonesia for locals and how much does expat health insurance cost—the latter typically being higher due to private provider access. Regional comparisons show that health insurance in Thailand offers competitive rates, while health insurance in South Korea is known for its efficiency under the national system. For travelers and students, policies like health insurance for Germany visa are often mandatory. Globally, the cost of health insurance in 2025 continues to rise, making it crucial for individuals to compare options whether they are based in Asia or navigating systems like health insurance Korea for temporary or long-term stays.

Final Thoughts

In conclusion, understanding the costs of health insurance in 2025 is essential for making informed decisions about your healthcare needs. As premiums vary based on factors such as age, location, and plan type, it’s important to assess your options carefully. By being proactive and exploring different plans, you can find coverage that fits your budget and ensures you receive the care you need.

Thank you for reading this article, and don’t forget to share it with your friends. Goodbye, and we look forward to bringing you another interesting article soon!

1 thought on “How Much Does Health Insurance Cost Per Month In 2025?”