Choosing the right health insurance plan for your family is crucial for ensuring peace of mind and financial security. With various options and terms that can seem overwhelming, it’s important to clearly understand how to choose the right health insurance plan for your family. This guide provides key insights and practical steps to help you navigate the complexities of health insurance effectively.

What is How to Choose the Right Health Insurance Plan for Your Family?

When exploring how to choose the right health insurance plan for your family, it’s about selecting coverage that effectively meets the healthcare needs of each family member. Health insurance plans typically vary in cost, coverage, network, and additional benefits. Understanding these differences is essential to choosing a suitable policy.

ALT text: Family reviewing health insurance documents at home.

Benefits of How to Choose the Right Health Insurance Plan for Your Family

Selecting the right plan brings multiple benefits:

- Financial Protection: Prevents significant healthcare costs from affecting your family’s finances.

- Access to Quality Care: Provides access to a broad network of medical professionals and facilities.

- Preventive Services: Includes regular check-ups and screenings essential for maintaining family health.

- Peace of Mind: Knowing your family is covered in case of unexpected medical emergencies.

- Prescription Coverage: Helps reduce the cost of medications.

Comparison: How to Choose the Right Health Insurance Plan for Your Family

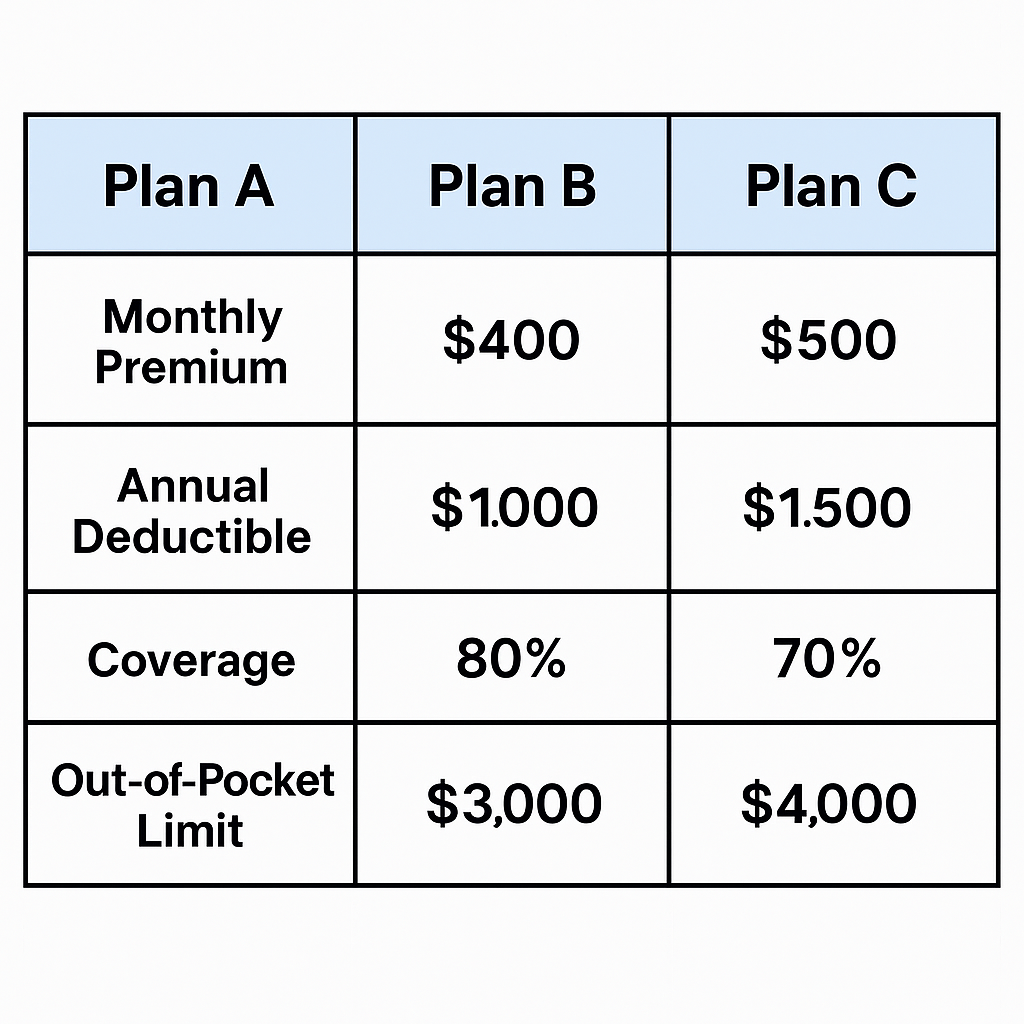

Comparing different plans is crucial. Consider these key factors:

- Premiums vs. Deductibles: Lower premiums often mean higher deductibles. Evaluate your family’s medical history to balance these costs effectively.

- Coverage Networks: Ensure your preferred doctors and hospitals are within the plan’s network.

- Prescription Benefits: Check the medication coverage provided by the plan.

- Additional Services: Look for added benefits such as dental, vision, and wellness programs.

ALT text: Health insurance comparison chart displaying premiums, deductibles, and coverage.

How to Choose the Best Plan Using How to Choose the Right Health Insurance Plan for Your Family

Follow these detailed steps to select the ideal insurance:

Step 1: Assess Family Needs

- List current and expected healthcare needs.

- Evaluate chronic conditions or regular prescriptions.

Step 2: Set a Budget

- Determine how much you can comfortably afford monthly.

- Include potential out-of-pocket expenses.

Step 3: Compare Plans

- Use online comparison tools with how to choose the right health insurance plan for your family keyword 2.

- Review coverage details using how to choose the right health insurance plan for your family keyword 3.

Step 4: Network Consideration

- Confirm your doctors and specialists are included in the provider network.

- Check proximity and accessibility of network hospitals and clinics.

Step 5: Review Exclusions and Limits

- Carefully examine exclusions, annual limits, and lifetime caps.

- Understand what conditions or treatments may not be covered.

Step 6: Evaluate Reviews and Ratings

- Check customer reviews and ratings online for insights into customer service and claim processes.

ALT text: Checklist illustrating steps for choosing health insurance.

Frequently Asked Questions

What should I prioritize when choosing health insurance?

Prioritize coverage, affordability, provider network, and additional benefits based on your family’s specific health needs.

How do I know if my preferred doctor is covered?

Most insurers offer online tools or customer service lines to verify if your doctor is within their network.

Is it worth paying a higher premium for lower deductibles?

This depends on your family’s healthcare needs. Families with frequent healthcare needs often benefit from lower deductibles despite higher premiums.

Can I change my health insurance plan later?

Yes, typically during annual open enrollment periods or after significant life events like marriage, childbirth, or job changes.

Conclusion

Choosing the right health insurance plan for your family is essential for your family’s health and financial security. By assessing your specific needs, budgeting carefully, comparing detailed options, and understanding coverage networks, you can select the best possible plan. Remember, investing time in thorough research ensures long-term peace of mind.

Ready to choose your family’s ideal health insurance plan? Start today and secure your family’s health and financial stability.

m8z8d0